A cash-out refi relies on having out A much bigger balance with your Key home finance loan. It’s a completely new loan with another curiosity price and possibly a longer or shorter expression. It’s a lump-sum payment like a home equity loan, however , you have only a person mortgage payment moving forward.

To aid, we’ve put together this information on how to get a primary-time own loan without any credit score historical past. Permit’s walk via the method in order to have an understanding of your choices.

Invest in a home, refinance or take care of your mortgage loan on-line with The united states's most significant home finance loan lender*. Save far more, expend much less, see anything, and consider again control of your financial daily life. Obtain a housing agent handpicked in your case and search the latest household listings. Rocket Loans

Missed payments and loan default are claimed to your credit history bureaus and will negatively effect your credit rating rating. Plus, a loan default can keep on your own credit history history for up to 10 years.

Very same-working day loans can provide you with quick cash, but can include substantial charges and costs. Learn how and where by to secure a identical-day loan, plus the challenges involved.

You may use that money for just about anything, irrespective of whether you want to establish a master bedroom suite, pay back significant-curiosity amount bank card debt or pay back for a child’s college tuition.

If you're using the funds to pay back personal debt at closing, you are able to do a personal debt consolidation using a qualifying credit rating score of as low as 580. All other uses for the cash-out refinance demand a median FICO® Rating of 620 or far better.

After you’ve decided on a lender and precise loan products, you’ll must formally apply for a private loan with the required documentation.

Kevin Graham can be a Senior Weblog Author for Rocket Organizations. He focuses primarily on economics, property finance loan qualification and private finance subject areas. As someone with cerebral palsy spastic quadriplegia that requires the usage of a wheelchair, he also takes on articles or blog posts all over modifying your property for Actual physical difficulties and clever house tech.

Concentrate to your APR. Your annual percentage charge (APR) on the loan is the most significant convey to of the loan’s affordability and Whatever you’ll fork out in fascination. Lenders are lawfully expected to reveal a loan’s APR, so Watch out for any lender who doesn’t.

Secured bank card: Using a secured credit card, you’ll ought to place a refundable stability deposit down when implementing. You’ll demand purchases on this card as many as website the quantity you place down as the security deposit.

Irrespective of whether you need to apply for an FHA cash-out refinance is dependent upon what you require The cash for, exactly how much you owe on your present home finance loan and what your private home is truly worth.

Giving an employer telephone number considerably boosts your possibilities of acquiring a loan. When you are on Positive aspects, You need to use the phone number of the government office that provides your Gains. Enter Employer Telephone

The equilibrium also variations every month according to your personal spending and payment cycles. The provider sets your restrictions based upon variables like your cash flow and prior credit history history.

Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Tina Majorino Then & Now!

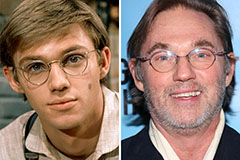

Tina Majorino Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!